35 Stats for the Future of Virtual Care in 2026 and Beyond

Discover the top 35 statistics and insights from our virtual care report to help you understand the current state of telehealth and what to prioritize in the coming year.

As telehealth transitions from an emergency solution to a permanent part of healthcare delivery, our research on the state of virtual care reveals what’s next for the industry.

We surveyed 163 telehealth professionals across the world, including clinicians, executives, developers, and product leaders, to uncover how the industry is performing today and where it’s headed next.

This article highlights the top 35 statistics and insights from the report to help you understand the current state of telehealth and what to prioritize in the coming year.

Want to dig deeper? Read the full report here.

Telehealth’s market forecast

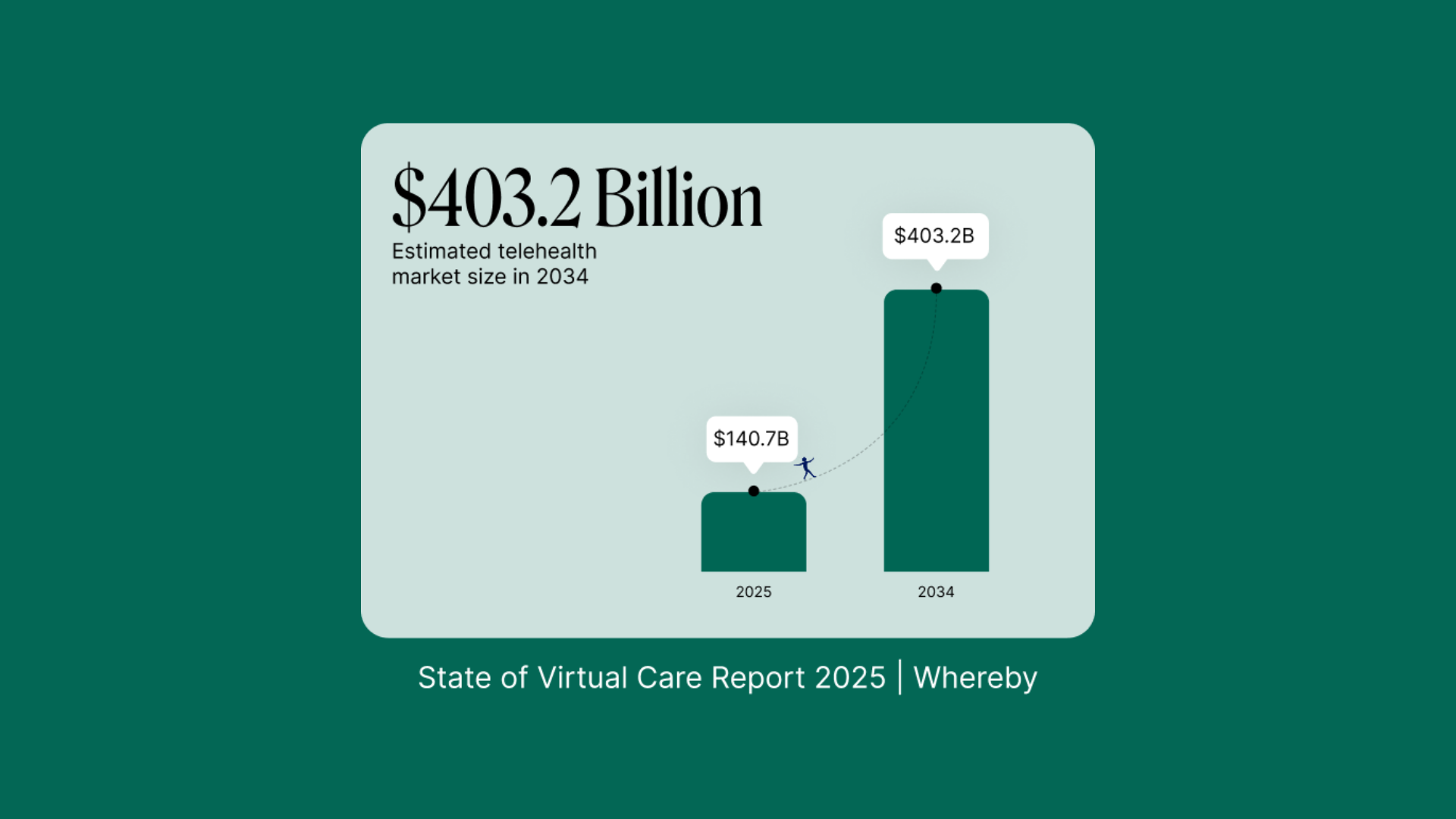

1. The global telehealth market is projected to grow from $140.7 billion in 2025 to $403.2 billion by 2034 (Global Market Insights). That’s a near 3× increase in less than a decade.

2. In 2024, there were over 116 million users of online doctor consultations worldwide, up from around 57 million in 2019 (Statista).

Telehealth is no longer a temporary alternative to in-person care. It’s now the foundation for the future of connected care.

Engagement is virtual care’s biggest challenge and priority

3. Patient engagement is both the #1 challenge (22%) and the #1 future priority (55%) for telehealth providers.

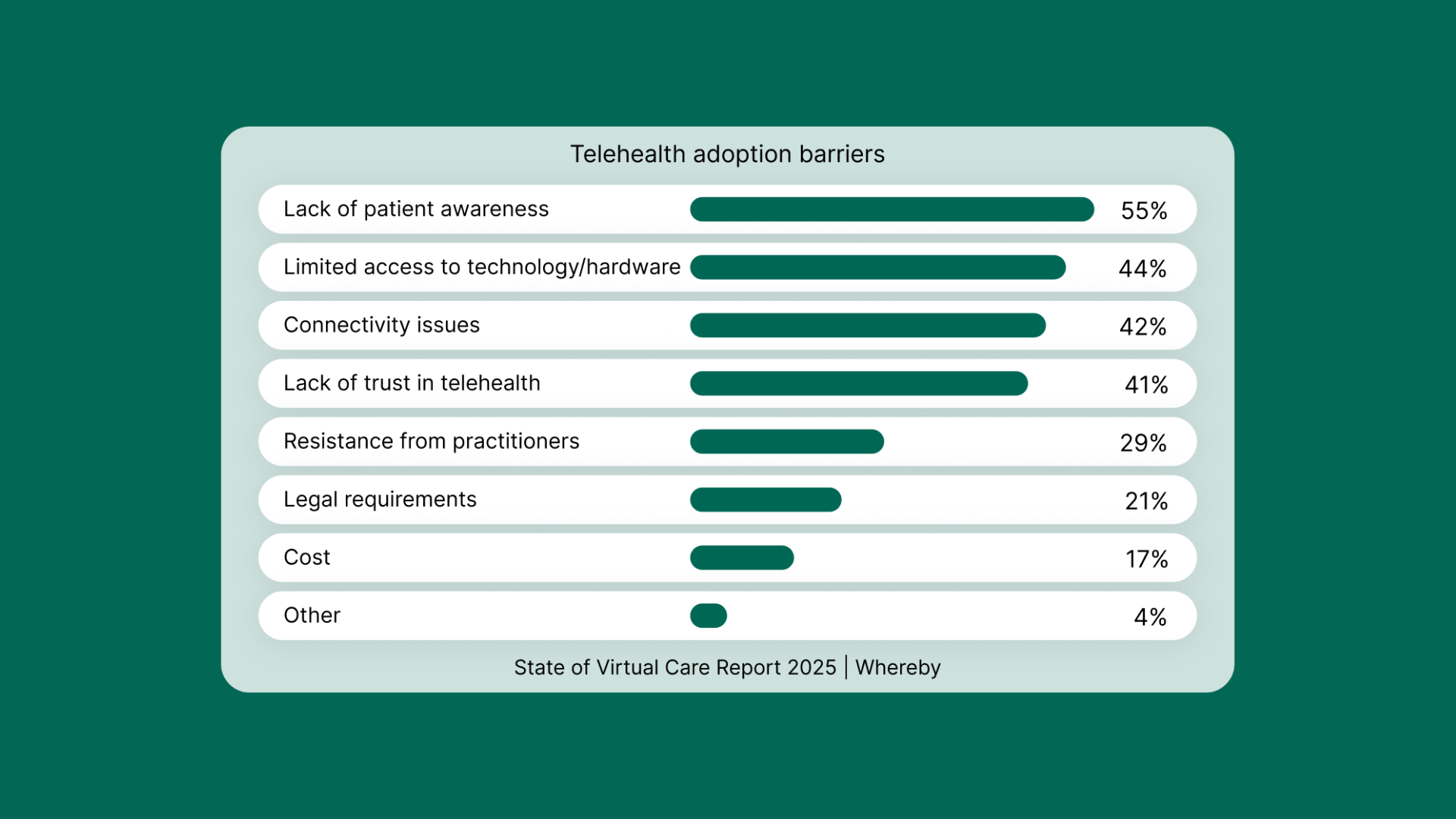

4. 55% of respondents think that lack of patient awareness limits virtual care adoption.

5. 44% cite limited access to technology, and 42% cite connectivity issues as the factors limiting telehealth adoption.

6. 41% say lack of trust in telehealth is a major adoption barrier for telehealth.

Engagement remains the leading goal for 2026, ahead of growth or feature innovation. Without engaged patients, even the best technology won’t deliver better outcomes.

Technical reliability is still a core issue

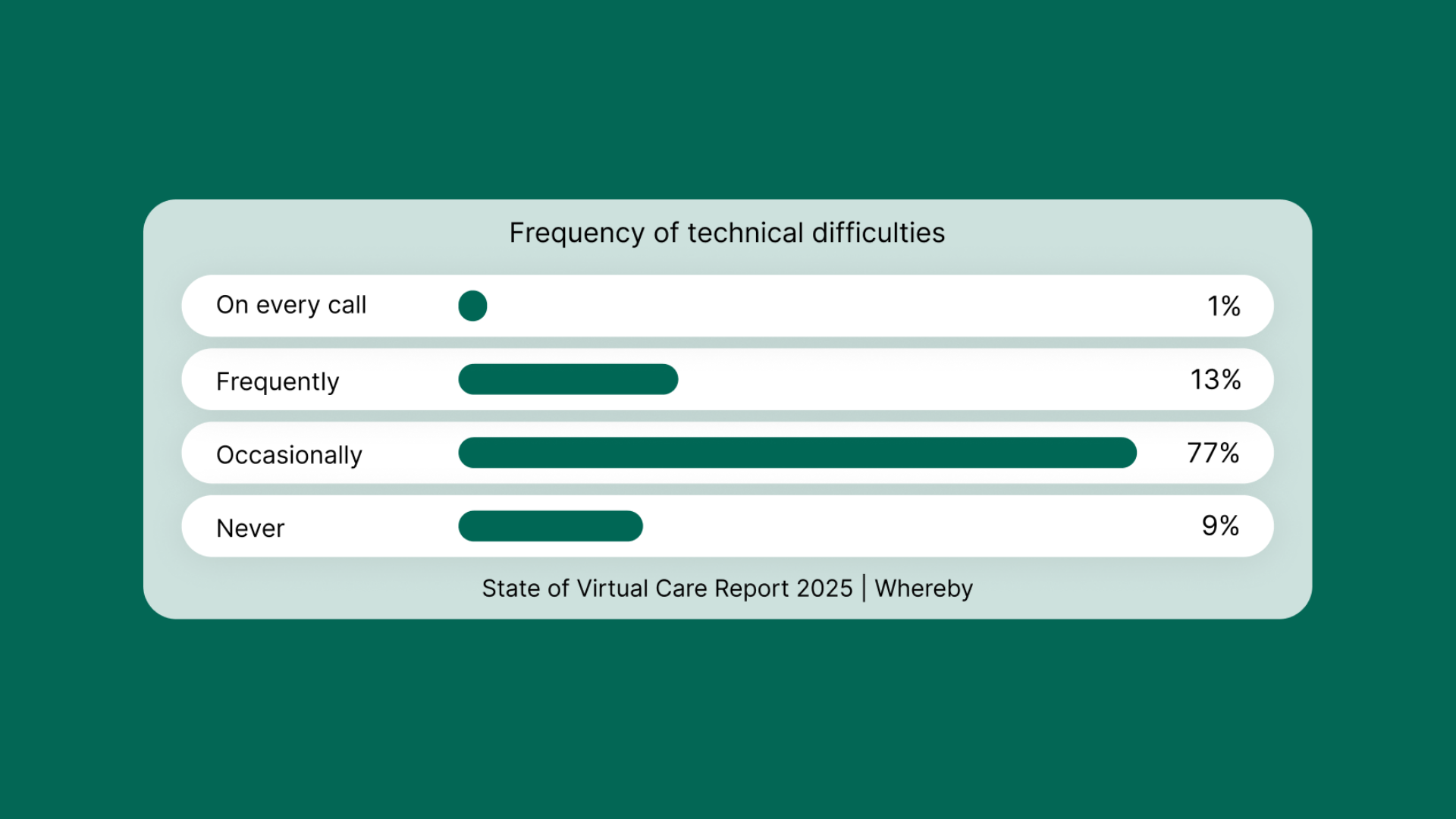

7. 91% of telehealth professionals report that they or their users experience technical difficulties at least occasionally.

8. Only 9% say they “never” encounter technical issues.

9. Average satisfaction with current virtual care UX is 7.2 out of 10, but only 16% rate it “excellent”(9-10 out of 10).

10. 66% cite call quality/reliability as the top factor when choosing a video platform. This is higher than even cost or new features.

Reliability remains the make-or-break factor for virtual care adoption. If the foundations in telehealth are faulty, then the new features won’t matter to practitioners and patients.

There’s not a lot of security and privacy confidence in telehealth

11. Only 56% of respondents feel confident or very confident in their telehealth platform’s data privacy and protection.

12. 42% rank privacy/security compliance as the single most important factor when choosing a video call provider.

13. 15% are “very confident” in their telehealth platform’s data security, while 2% are not confident at all

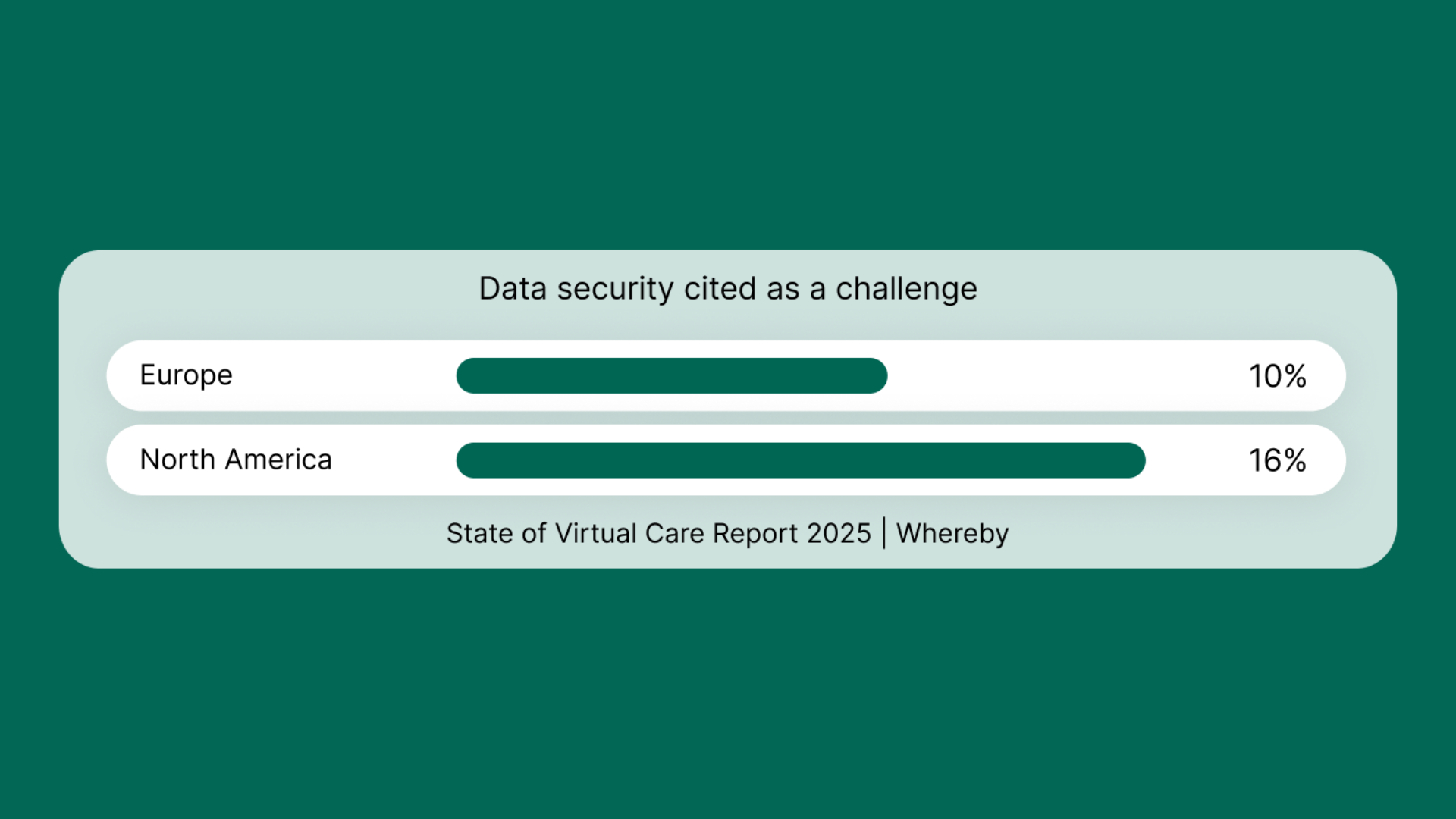

14. In North America, 16% cited data security as a top concern versus 10% in Europe.

While platforms are investing in security, trust in digital care still depends on visible, transparent security practices. Use clear signals to show how well you take their privacy and security seriously.

Regions face different challenges: Europe vs. North America

15. Regulatory compliance is a bigger concern in Europe (18%) than in North America (11%).

16. 11% of European respondents report never experiencing video issues, versus 5% in North America.

17. 16% of North American respondents highlight data security as a top concern (vs. 10% in Europe).

18. 50% of European respondents cite a lack of trust in telehealth, compared to 28% in North America.

19. Conversely, 51% of North American respondents cite limited access to technology as a major adoption barrier to telehealth, versus 39% in Europe.

North America struggles with access, while Europe struggles with trust.

Cost pressures are a quiet but persistent constraint

20. 15% of builders and facilitators say financial sustainability is the biggest challenge in telehealth.

21. 40% of professionals cite cost as a major integration barrier, and 45% say it’s an important factor when selecting video call partners.

22. Interestingly, only 4% of C-suite leaders call cost their top concern, compared with 27% of product managers, who feel the pressure of budgets more directly.

23. Looking ahead, 37% of respondents list cost reduction as a strategic goal for 2026

While innovation and engagement dominate strategy discussions, cost remains a quiet but persistent constraint for telehealth teams.

Internal teams aren’t as aligned as we think

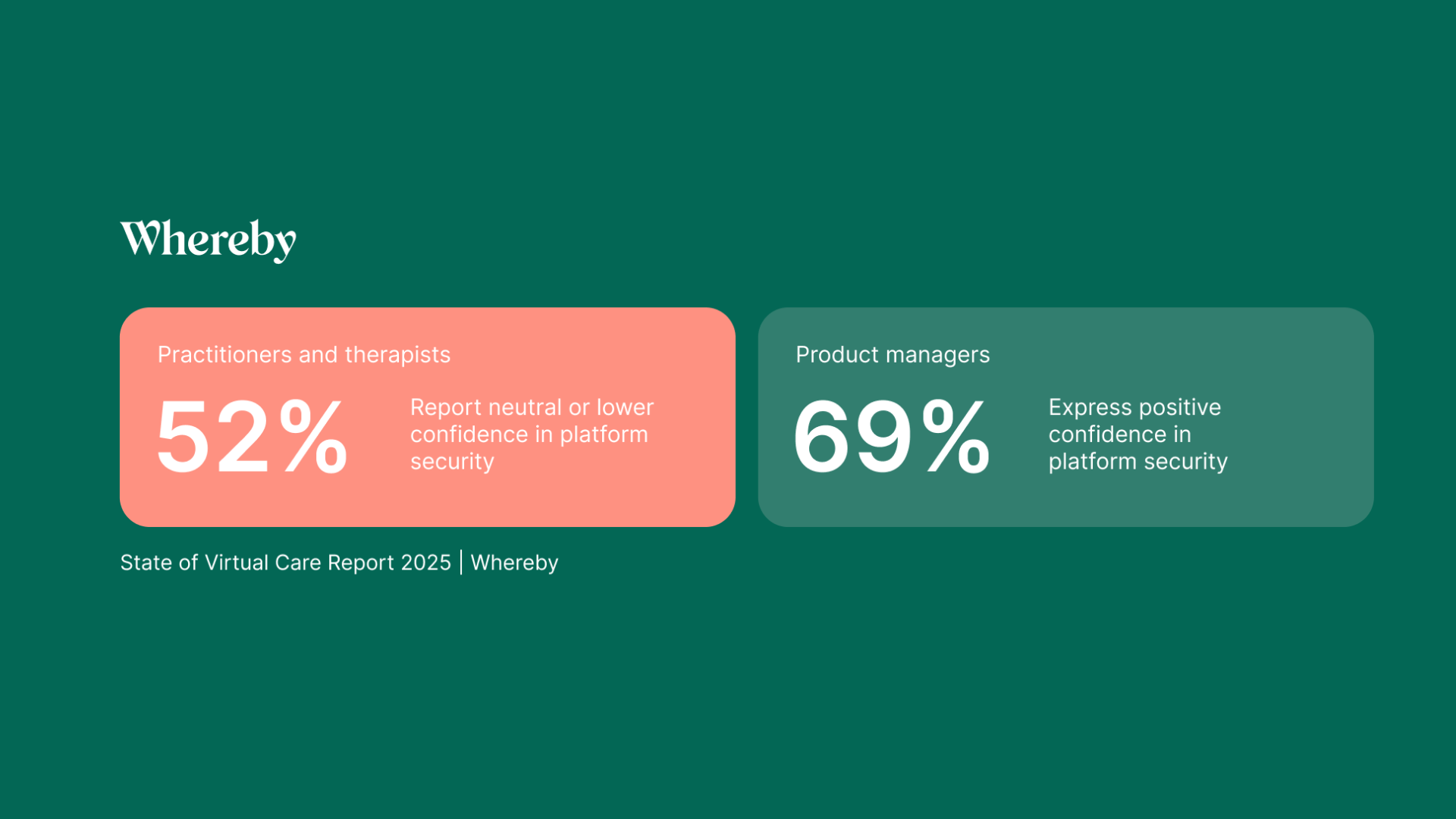

24. Practitioners/Therapists: 52% lack confidence in data security. Their top focus? Ease of use (67%) and privacy (71%).

25. Product Managers: 69% express confidence in platform security; 27% say cost is their top concern, and care more about innovative features (34%).

26. C-Suite Leaders: Prioritize engagement (64%) and growth (53%), but rarely cost (only 4% list it as top).

27. Developers/Engineers: Focus most on feature innovation (64%) over UX (52%).

Teams aren’t always aligned, so bridging these internal gaps is important to improve patient outcomes. Find out how to improve alignment within telehealth teams.

Integration and technology barriers are slowing down innovation

28. 50% of respondents say integration complexity is their biggest obstacle to embedding video technology.

29. 40% cite cost, and 37% report a lack of IT or engineering resources as their biggest obstacle.

30. Only 16% of users rate their current virtual care user experience as “excellent”(9-10 out of 10), and 25% rate it 6 or below.

What matters when choosing a video call provider

31. The top decision drivers when selecting a video call provider for telehealth include: call quality/reliability (66%), ease of use (58%), privacy/security (58%), and device compatibility (50%).

32. Cost ranks fifth (45%), showing that usability and compliance outweigh price when choosing a video call vendor.

33. Innovation of new features ranked lowest at 22%.

Future strategic priorities for telehealth

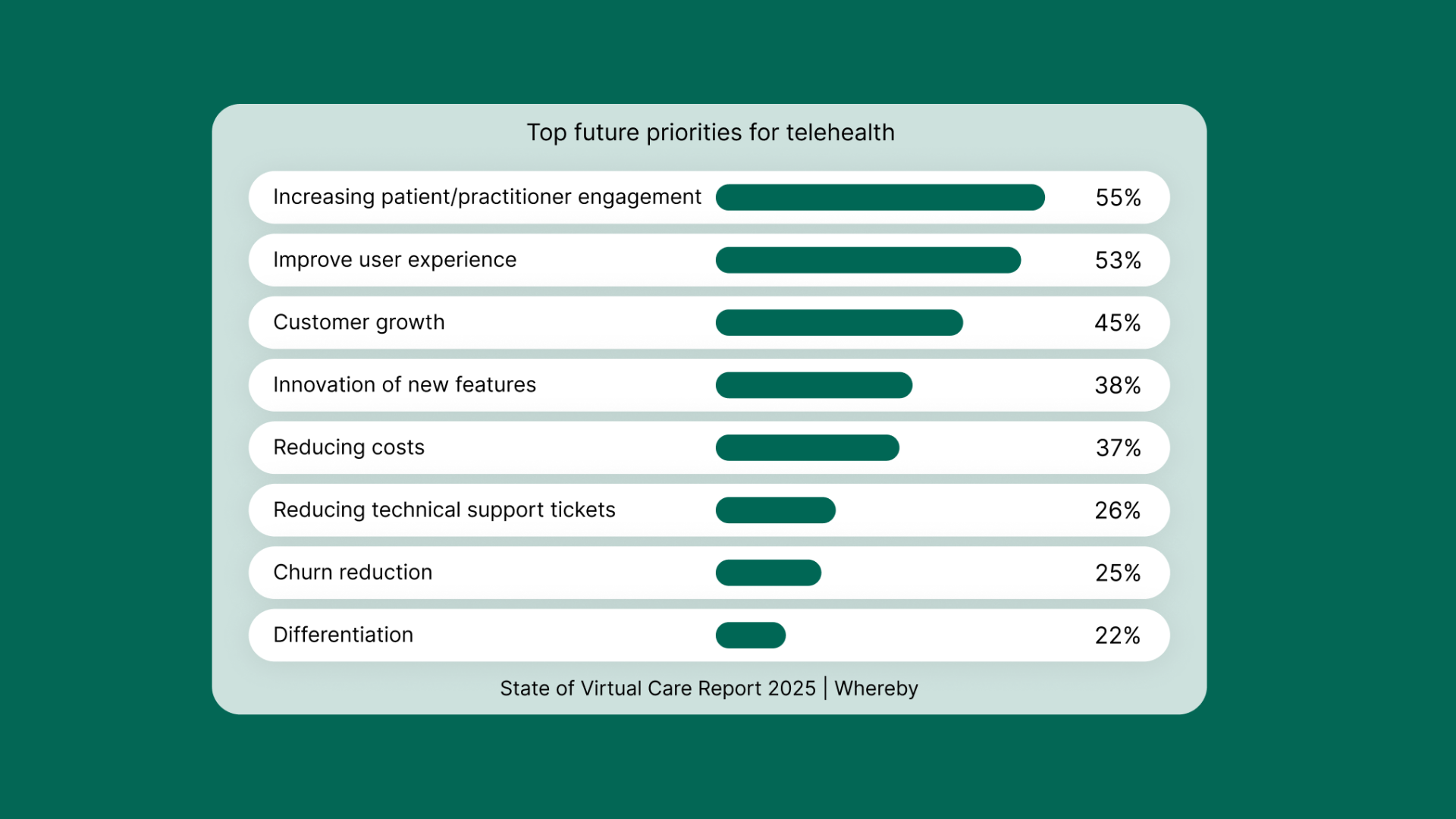

34. According to our survey, the overall top priorities for 2026 are: increasing patient/practitioner engagement (55%), improving user experience (53%), customer growth (45%), feature innovation (38%), and cost reduction (37%).

35. Secondary priorities include reducing technical support tickets (26%), churn reduction (25%), and differentiation (22%).

Growth and engagement are now inseparable. This means improving your telehealth user experience will increase competitive advantage in the coming year.

Wrapping up

In every region and role, one message rings clear: the future of virtual care will be defined by platforms that prioritize reliability, privacy, and human-centered design.

This is because the goal is no longer just about expanding access in telehealth. It’s now about strengthening relationships between patients, providers, and technology in order to enable better care experiences.

To see the full insights shaping this change, read the full report on the state of virtual care.